What are the main requirements for companies when obtaining a crypto license?

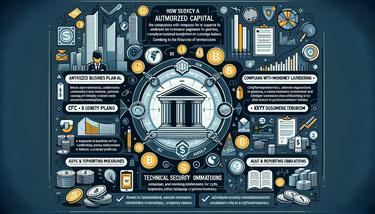

Obtaining a cryptocurrency[1] license is a crucial step for companies operating in the digital asset space. This process involves meeting a series of stringent requirements designed to ensure compliance[2] with regulatory standards, safeguard customer assets, and promote transparency[3]. The main requirements typically include:

- Authorized Capital

- Detailed Business Plan

- Compliance with Anti-Money Laundering (AML) Requirements

- Funding of Terrorism (CFT)

- “Know Your Customer” (KYC) Policy

- Technical Security

- Audit and Reporting

- Key Facts

- What are the main requirements for companies when obtaining a crypto license?

- Legal Structure and Registration

- Comprehensive Business Plan

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Policies

- Data Protection and Privacy Measures

- Capital Requirements and Financial Audits

- Operational Security and Infrastructure

- Ongoing Compliance and Reporting

Authorized Capital

Companies are required to have a minimum amount of authorized capital, demonstrating financial stability[4] and the ability to cover operational risks. The specific amount varies by jurisdiction but serves as a buffer against financial insolvency.

Detailed Business Plan

A comprehensive business plan outlining the company’s operations, revenue model, compliance measures, and security protocols is essential. This demonstrates to regulators the company’s preparedness and long-term viability.

Compliance with Anti-Money Laundering (AML) Requirements

Companies must establish robust AML policies to prevent and detect money laundering[5] activities. This includes implementing systems for monitoring transactions and reporting suspicious activities to relevant authorities.

Funding of Terrorism (CFT)

Similar to AML, companies are required to have measures in place to combat the financing of terrorism. This involves screening and monitoring transactions to ensure they do not support terrorist activities.

“Know Your Customer” (KYC) Policy

A KYC policy is mandatory for identifying and verifying the identities of customers. This process helps prevent fraud, money laundering, and other illicit activities by ensuring that customers are who they claim to be.

Technical Security

Companies must implement high standards of technical security to protect customer data and assets. This includes the use of encryption[6], secure communication channels, and regular security audits[7].

Audit and Reporting

Regular audits and reporting are required to ensure ongoing compliance with regulatory standards. Companies must maintain transparent records and report to regulatory bodies as required.

Meeting these requirements is essential for companies seeking to obtain a cryptocurrency license. It demonstrates a commitment to regulatory compliance[8], customer protection, and the integrity of the financial system.

Key Facts

- A minimum authorized capital is required to ensure financial stability.

- A detailed business plan must outline the company’s operational, compliance, and security strategies.

- Compliance with AML and CFT regulations is mandatory to prevent illicit activities.

- Implementing a KYC policy is crucial for verifying customer identities.

- High standards of technical security are necessary to protect data and assets.

- Regular audits and reporting ensure ongoing compliance with regulatory standards.

What are the main requirements for companies when obtaining a crypto license?

Obtaining a cryptocurrency license is a critical step for companies looking to operate legally within the rapidly evolving digital asset landscape. This process involves navigating a complex web of regulatory requirements that vary significantly across jurisdictions. Despite these variations, several core requirements emerge as common denominators worldwide. Understanding and complying with these requirements is crucial for businesses aiming to leverage the burgeoning opportunities in the crypto space while ensuring integrity, security, and trustworthiness in their operations.

Legal Structure and Registration

Before venturing into the crypto market, companies must establish a clear legal structure that complies with the jurisdiction’s corporate governance[9] standards where they intend to operate. This involves registering the business with the relevant authorities, which may include obtaining a specific legal status[10] that permits cryptocurrency activities. The choice of jurisdiction is strategic, as it impacts the regulatory obligations, tax implications, and operational freedoms the company will have.

Comprehensive Business Plan

Regulators often require a detailed business plan that outlines the company’s objectives, target market, operational processes, and financial projections. This plan should also include an in-depth analysis of the risks associated with the company’s crypto activities and the strategies in place to mitigate these risks. A well-structured business plan demonstrates the company’s preparedness and commitment to conducting its operations responsibly and sustainably.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Policies

AML and KYC[11] policies are at the heart of crypto regulatory requirements. Companies must establish robust systems to prevent money laundering and terrorist financing. This includes implementing procedures for customer identification, transaction monitoring[12], and reporting suspicious activities to the relevant authorities. The KYC process involves collecting and verifying customer information to establish their identity and assess their risk profile.

Data Protection and Privacy Measures

With the increasing emphasis on data security and privacy, crypto companies are required to adopt stringent measures to protect sensitive customer information. This involves deploying advanced cybersecurity technologies, establishing secure data storage practices, and ensuring compliance with global data protection regulations such as the General Data Protection Regulation (GDPR) in the European Union.

Capital Requirements and Financial Audits

Regulators may impose minimum capital requirements to ensure that crypto companies have adequate financial resources to manage their operations and absorb potential losses. Additionally, companies might be required to undergo regular financial audits conducted by certified auditors. These audits provide transparency into the company’s financial health and compliance with accounting standards.

Operational Security and Infrastructure

The technical infrastructure supporting crypto activities must be robust, secure, and capable of handling the specific demands of cryptocurrency transactions. This includes secure wallet[14] management, transaction processing systems, and contingency plans for cyber threats. Operational security protocols must be in place to protect against unauthorized access, data breaches, and other cyber risks.

Ongoing Compliance and Reporting

Obtaining a crypto license is not a one-time event but the beginning of an ongoing compliance journey. Companies must continuously monitor and adapt to changing regulatory landscapes, including filing regular reports with authorities, updating policies and procedures, and conducting internal audits to ensure compliance.

In conclusion, obtaining a cryptocurrency license requires thorough preparation, adherence to stringent regulatory standards, and a commitment to operational excellence. By meeting these requirements, companies can navigate the complexities of the crypto regulatory environment[15], build trust with customers and regulators, and capitalize on the opportunities in the dynamic world of digital assets.

- Cryptocurrency — Digital or virtual currency secured by cryptography, facilitates secure, anonymous transactions.

- Compliance — The act of adhering to legal standards and regulations established by governmental bodies and regulatory agencies, particularly in the context of financial operations and transactions involving cryptocurrencies.

- Transparency — The characteristic of blockchain technology that allows all transactions to be visible and verifiable by all network participants.

- Financial Stability — A requirement for license applicants to demonstrate sufficient financial resources to cover operational expenses and obligations to players.

- Money Laundering — The process of making large amounts of money generated by a criminal activity appear to be legally obtained.

- Encryption — The process of converting information or data into a code, especially to prevent unauthorized access.

- Security Audits — Independent examinations of a gambling operation's systems and practices to ensure compliance with security standards and the protection of customer data and funds.

- Regulatory Compliance — Adherence to laws, regulations, guidelines, and specifications relevant to business processes.

- Corporate Governance — The framework of rules, practices, and processes by which a gambling company is directed and controlled, ensuring accountability and fairness.

- Legal Status — The classification of cryptocurrencies within a legal and regulatory framework, determining how they are recognized and regulated by law (e.g., as property, currency, or securities).

- AML and KYC — Anti-Money Laundering and Know Your Customer regulations aimed at preventing financial crimes by verifying the identity of clients.

- Transaction Monitoring — The continuous oversight of player transactions to identify suspicious patterns that may indicate fraudulent activity or money laundering.

- Data Protection — The practices and policies that ensure the confidentiality and integrity of user data against unauthorized access and breaches.

- Wallet — A digital tool that allows users to store and manage their cryptocurrency addresses.

- Regulatory Environment — The legal and regulatory framework within which ICOs must operate, varying significantly by country.